Rain beat down on the building as members of SMBA filed into the cosy and charming space of Chalet Suisse located off Jalan Ampang. Introductions were made as some of the members met for the first time, and attendees shared cocktails before the talk. Light conversation ensued as members enjoyed mini-sandwiches, quiche and fried spring rolls while waiting for others to arrive.

The group then proceeded upstairs where a slide presentation had been set up by the UBS team. Ms Aileen Chan, Secretary of SMBA warmly introduced the speaker of the day, Mr Kelvin Tay, Managing Director and Chief Investment Officer, Southern APAC at UBS. Kelvin is a member of the UBS Global Emerging Markets Investment Committee, as well as the Asia-Pacific Investment Committee where he provides strategic research and inputs to the investment and asset allocation process across asset classes. Globally, he is one of the most sought after speakers in UBS, with an impressive professional history of working with companies such as Deutsche Bank Private Wealth Management (Asia) and JP Morgan Chase.

US and UK Economy Post Brexit

Kelvin began his talk by informing members that despite the economic slowdown this year, there would be no need to fear a recession. Using a chart showing economic progress, he demonstrated that there would likely be a 3% economic growth this year, and potentially a 3.4% growth next year. According to Kelvin, the main engine of global growth is the United States (USA) as its economy is firing on all cylinders and impacting the economy of many other countries as well. His research also showed that the US needs to generate around 80,000 to 100,000 jobs for the rest of the year for the economy to continue its growth. Currently, the US economy is moving steadily because wages have risen and mortgage prices have dropped, causing a rise in consumption.

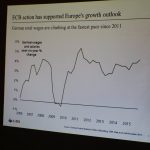

Moving on to Europe’s economy, Kelvin stated that unemployment rates were relatively low especially in regions such as Germany, although still high in southern Europe. Since 2007, wages in Germany have been climbing at a fast pace, causing local authorities to disregard the negative interest rate policy there. While this policy is not necessary for Germany, they are vital for assisting countries such as Spain and Italy, whose economies are moving at a slower pace.

Kelvin went on to discuss Brexit and the extremely negative impact it has had on the United Kingdom (UK); the main reason being that 44.4% of the UK’s economy consists of exports to the EU. This affects the trading process for the UK as it will not be allowed to trade to its biggest partners Germany and France, on the same terms as before. The sterling is also facing negative impacts due to factors such as an estimation of 0% growth in the UK economy during the next year, the Central Bank cutting interest rates and the UK losing its AAA rating. Additionally, he spoke about the impact Brexit would have on the price of residential and commercial property in the UK, which he recommends is only advisable to purchase a few years from now. However, his analysis showed positive signs for the retail sector due to tourists who are likely to travel to London this year.

Oil Prices

Oil prices have made a significant drop as many companies cannot afford to fund the capital expenditures anymore. The supply of oil is expected to drop due to the number of producers collapsing, impacting US inventory at 55 USD per barrel at the end of the year. With room for an increase in oil prices, the outlook could be very positive for the US stock market because nearly 20% of the market cap in the S&P 500 Index comprise of US energy companies.

Asian Economy

In Japan, there is minimal consumption despite the fact that unemployment rates are at a lowly 3.5% to 4%. This is because the Japanese population is getting older and increasing their savings. Nevertheless, an increase in savings and stagnant improvement of wages causes the Japanese to spend less. Besides that, the Japanese population shrinks every year by 230,000- 250,000 people, providing no need for a negative interest rate policy. Discouraging investment in the Japanese stock market, Kelvin quotes the first Singaporean Prime Minister, Mr Lee Kuan Yew as he says that “Japan is a slow walk into mediocrity”.

Attendees were also glad to be informed that Brexit does not affect the Asian economy, except for Vietnam and Cambodia. The impact on Asia’s economy is largely caused by their exposure to the European Union. For example, 30% of Singapore’s gross domestic product (GDP) are exports to the EU. Kelvin anticipates a 0.2% decrease, but does not expect a material slowdown in the EU economy. He also mentioned that the German government had issued 10-year bonds at negative rates, which has never been done before. Asia’s economy has been growing at the slowest rate for the last 16 years at only 5.9%. “Our exports are not likely to improve this year, leaving Asian stock market trading at close to recession values,” says Mr Kelvin.

He then addressed China’s economy, mentioning that the Chinese Yuen was a very important currency that influences the rate of other Asian currencies. This is due to the fact that China currently has the biggest export and import industry. No longer interested in low-cost manufacturing, China is intent on transitioning to competing globally against the Koreans, Japanese, Swiss, Germans, Singaporeans and the Taiwanese. Instead of a fixed-asset investment economy, it is changing into a consumer-oriented economy.

The biggest problem with China is their soaring debt levels at 150% to 200% this year. However, Kelvin insisted that their debt composition levels are very different as there is a low percentage of government debt. Also, most of the debt comes from within the country, not borrowed from other countries – which makes the problem a less serious one. It may come as a surprise to many that the country is able to afford higher debt levels because they have a high savings rate.

Bringing the topic closer to home, Kelvin explained that Malaysia’s economy will expect a growth of only 3.6%, but the foreign exchange reserves have actually stabilised due to stable oil prices. Nonetheless, the Malaysian economy will face problems involving the decrease of inflation, primarily caused by the high household debt to GDP. Another cause is the country’s implementation of the GST policy. The property market in Kuala Lumpur is at a slowdown, largely due to the demand for oil, gas, rubber and palm oil sectors which have become almost non-existent. With the decrease in consumption, Malaysia is in for a prolonged period of slow growth.

In closing his speech, Kelvin talked about the future of our ever-changing economy in which we are in the 4th Industrial Revolution – simplified by extreme automation and extreme connectivity. We live in a world formed by user-generated content and demand which creates supply. Manufacturing jobs are being passed over to robots, along with a time where jobs for traditional industries, such as print and broadcast media, are at an all-time low.

At the end of his informative and well-researched presentation, Kelvin was presented with a token of appreciation by Mr Alain Augsburger, Chairman of SMBA. The attendees then headed downstairs where they experienced a three-course meal comprised of appetisers, mains and a dessert, and the networking continued over the delicious servings.